Initiatives for Governance

While the executive director of INV concurrently serves as the representative director at CIM, two supervisory directors (an attorney and a certified public account) oversee the execution of the executive director's duties via the Board of Directors of INV.

Compliance Initiatives and System

CIM has a compliance officer who is responsible for compliance with laws, regulations and other relevant matters as well as overall management of transactions with sponsor related parties. Moreover, CIM has in place a compliance committee which, chaired by such compliance officer, is in charge of deliberating on compliance with laws, regulations and other relevant matters as well as transactions with sponsor related parties.

In addition to the President and CEO of CIM, the full-time directors, the General Manager of the Planning Department, and the auditor (an observer), Compliance Committee meetings are attended by an outside expert (an attorney) who, sitting in as a committee member, conducts rigorous deliberations on the existence of conflicts of interest in transactions with sponsor related parties, remedial and preventive measures against inappropriate behavior in compliance with laws and regulations, and identification of interested parties related to other operations, as well as strict examinations with respect to INV's compliance with laws and regulations. No resolution will be adopted unless the outside expert agrees.

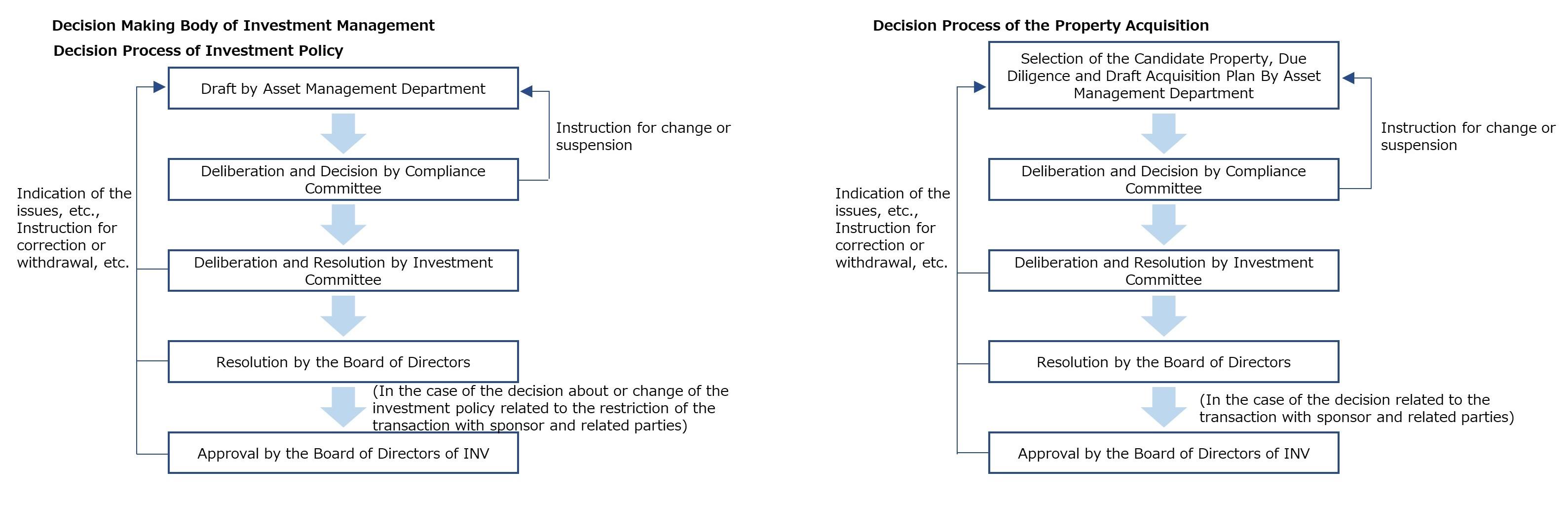

The roles of the Compliance Officer and the Compliance Committee in decision-making of individual operations are extremely important, and in addition to deliberations and approvals related to the acquisition, sale and management of individual properties, deliberations and approvals by the Compliance Committee are indispensable in investment policy, and unless the approval of the Compliance Committee is obtained, deliberations cannot proceed with the Investment Committee, the Board of Directors, and the Board of Directors of INV, ensuring the effectiveness of the internal checking function. In addition, CIM has established "Accident Handling Regulations" with the aim of handling accidents legally and promptly to resolve early and prevent recurrence, to prevent the loss of CIM's credibility and the expansion of losses, and to ensure the soundness of management.

Composition of the Board of Directors

The composition of INV's Board of Directors as of June 30, 2025 is listed below.

The Board is comprised of one executive director and two supervisory directors and is structured with an emphasis on diversity.

| Director count | 3 |

|---|---|

| Female director ratio | 33.3% |

| Average tenure | 6.70 years |

Status and Remuneration of Directors

Information about directors at the end of the 43rd and 44th Fiscal Periods is listed below.

One executive director and two supervisory directors were appointed during the 22nd General Meeting of Unitholders of INV held on December 19, 2024. The term of office is two years from December 19, 2024 for both the executive director and supervisory directors in accordance with the Articles of Incorporation.

| Position | Name | Gender | Qualifications | Reason for Appointment | Number of investment units held (Note 1) |

|---|---|---|---|---|---|

| Executive Director | Naoki Fukuda | Male | - | Since he has extensive experience and knowledge in real estate investment management and finance as well as experience as President and CEO of CIM, he will be able to promptly and appropriately manage INV's business. Accordingly, we have determined that he is well-qualified to be an Executive Director of INV. | 0 units |

| Supervisory Director | Yoshihiro Tamura | Male | Attorney | He has been deemed suitable for the position of Supervisory Director because he has sufficient knowledge and experience to objectively supervise the execution of duties by the Executive Director from a broad and informed perspective based on his knowledge and experience as a legal expert. | 0 units |

| Marika Nagasawa | Female | Certified Public Accountant | She has been deemed suitable for the position of Supervisory Director because she has sufficient knowledge and experience to objectively supervise the execution of duties by the Executive Director from a broad and informed perspective based on her knowledge and experience as an accounting professional. | 0 units |

- (Note 1)

- None of the executive director or supervisory directors hold investment units of INV in their own name or in the name of any other person.

Information about attendance at Board of Directors Meetings at the end of the 43rd and 44th Fiscal Periods is listed below.

| Position | Name | Independent Directors (Note 1) |

Attendance at Board of Directors Meetings (Note 2) | |

|---|---|---|---|---|

| 43rd Fiscal Period Ended December 2024 |

44th Fiscal Period Ended June 2025 |

|||

| Executive Director | Naoki Fukuda | - | 100% (15/15) |

100% (13/13) |

| Supervisory Director | Yoshihiro Tamura | 〇 | 100% (15/15) |

100% (13/13) |

| Marika Nagasawa | 〇 | 100% (15/15) |

100% (13/13) |

|

- (Note 1)

- "Independent directors" refer to independent directors who do not violate the standards regarding independence from executive directors and asset management companies, etc. stipulated in the Act on Investment Trusts and Investment Corporations.

- (Note 2)

- The number and percentage of attendance at the Board of Directors Meetings held during the 43rd and 44th Fiscal Period, ended December 2024 and June 2025 respectively.

Information about directors at the end of the 43rd and 44th Fiscal Periods is listed below. For records of remuneration for previous periods, please refer to the Asset Management Reports in the "IR Library".

In accordance with the provisions of the Articles of Incorporation, the maximum monthly amount of executive director remuneration is JPY 800,000 per person, and the maximum monthly amount of supervisory director remuneration is JPY 400,000 per person. The amount of such remuneration is determined by the Board of Directors. The total remuneration for each director is as follows:

| Position | Name | Directors' remuneration for each fiscal period (JPY thousand) | |

|---|---|---|---|

| 43rd Fiscal Period Ended December 2024 |

44th Fiscal Period Ended June 2025 |

||

| Executive Director | Naoki Fukuda | - | - |

| Supervisory Director | Yoshihiro Tamura | 2,400 | 2,400 |

| Marika Nagasawa | 2,400 | 2,400 | |

Status and Remuneration of Auditor

Information about auditor at the end of the 43rd and 44th Fiscal Periods is listed below. For records of remuneration for previous periods, please refer to the Asset Management Reports in "IR Library"

| Position | Name | Auditor's remuneration for operating period (JPY thousand) | |

|---|---|---|---|

| 43rd Fiscal Period Ended December 2024 |

44th Fiscal Period Ended June 2025 |

||

| Auditor | Ernst & Young ShinNihon LLC | 40,200 (Note 1) | 19,800 (Note 2) |

- (Note 1)

- The auditor's remuneration includes 1,200 thousand yen for auditing English financial statements and 21,300 thousand yen for non-audit remuneration. In addition, non-audit remuneration to a person belonging to the same network as the accounting auditor is 7,854 thousand yen.

- (Note 2)

- The auditor's remuneration includes 1,200 thousand yen for auditing English financial statements. In addition, non-audit remuneration to a person belonging to the same network as the accounting auditor is 4,896 thousand yen.

Appropriate Management of Conflicts of Interest

In order to accurately understand the possibility of conflicts of interest in transactions conducted by INV and to properly manage any potential conflicts of interest, CIM has established the "Regulations on Transactions with Sponsor-related Parties" and the "Manual on Management of Transactions with Sponsor-related Parties" as CIM's voluntary rules, in addition to regulations imposed by related laws and regulations. CIM has defined interested parties, such as CIM's shareholders, as "Sponsor-related Parties". CIM has defined transactions with potential conflicts of interest, such as the purchase and sale of properties with sponsor-related parties and the outsourcing of operations for a fee to sponsor-related parties, as "Transactions with Sponsor-related Parties" and has clearly defined the criteria and procedures for conducting such transactions. In conducting Transactions with Sponsor-related Parties, in addition to the approval by the Compliance Committee, including an external expert, prior approvals by the Board of Directors of INV are required to ensure an objectivity in deliberation regarding conflicts of interests. In such agenda, only two supervisory directors (a lawyer and a certified public accountant) will participate in the vote, and the executive director who concurrently serves as the representative director of CIM will not participate in the vote as he is a special interested party.

CIM properly manages conflicts of interest by following such established procedures.

Please refer to the link below for CIM's decision-making process.

https://www.invincible-inv.co.jp/en/profile/amcompany.html

Anti-Corruption Initiatives

CIM stipulates in its Compliance Rules and Compliance Manual that all of its officers and employees are prohibited from providing favors, benefits, etc. to civil servants or persons deemed as such. Furthermore, it stipulates that regardless of whether business-related transactions take place, it is prohibited to provide or accept favors, benefits, etc. that exceed the scope of courtesy based on socially accepted conventions. Neither INV nor CIM makes any contributions or disbursements to political campaigns, political organizations, lobbyists, or lobbying groups.

Measures against Anti-Social Forces

CIM shall maintain a firm stance to seclude and eliminate itself from any relationship with anti-social forces* in order to retain credibility of financial instrument business operators with the public and secure appropriate and sound business operations as a financial instrument business operator. CIM shall also maintain a firm stance to respond, as an organization, to any unjustified demands in cooperation with external organizations such as the police and lawyers. Regarding the above matters, CIM shall comply with the "Comprehensive Guidelines for Supervision of Financial Instruments Business Operators, etc." issued by the Financial Services Agency and the "Guideline for How Companies Prevent Damage from Anti-Social Forces" (agreed upon at the Ministerial Meeting Concerning Measures Against Crime on June 19, 2007). At the same time, we will internally stipulate actual procedures such as preventive measures and handling strategies in our "Compliance Rules" and "Handling Guidelines for Pre-confirmation of Business Partners/Clients (investigation of anti-social forces)" as well as educate and thoroughly inform officers, employees, etc. through compliance training and such.

*As defined in the government's "Guideline for How Companies Prevent Damage from Anti-Social Forces," and "Outline of Measures against Organized Crime," a circular notice issued in the name of the Deputy Commissioner General of the National Police Agency.

Initiatives Relating to Anti-Money Laundering and Countering the Financing of Terrorism

In recent years, the importance of countermeasures to anti-money laundering and financing of terrorism (hereinafter referred to as "money laundering, etc.") as an issue that needs to be addressed by both Japan and the global society has been growing. In collaboration with the relevant government ministries and agencies, financial institutions have been striving to maintain sound financial systems by enhancing their management systems for cutting off the flow of funds connected with criminals, terrorists, etc. (i.e., money laundering).

Recognizing the importance of measures against money laundering, etc., CIM has formulated the "Provisions Concerning the Act on Prevention of Transfer of Criminal Proceeds" and the "Business Manual Related to the Act on Prevention of Transfer of Criminal Proceeds" to comply with relevant laws and regulations, and to appropriately carry out prescribed procedures such as various confirmation procedures, as well as audits conducted by the supervising officer (compliance officer).

Establishment of Whistleblower System

With an aim to contribute to strengthening compliance management, CIM has established a "Compliance Consultation Desk" which allows its officers and employees (including contract and temporary employees) to report or discuss fraudulent acts. The "Compliance Consultation Desk" targets inappropriate acts in terms of compliance as the subject for reports and consultation, and protects the whistleblowers in accordance with the Whistleblower Protection Act, (including prohibition of disadvantageous treatment, responding to anonymous reports and keeping the content confidential). The Compliance Consultation Desk detects and corrects reported fraudulent acts as well as provides feedback to the informant (excluding cases of anonymity) and if the Compliance Officer deems it necessary, the Compliance Committee will meet to discuss the response. In addition to an in-house contact point, an external attorney is appointed as the reporting contact point in order to secure effectiveness of the whistleblower system.